With over 20 million residents, Lagos State is not only the most populous city in Nigeria but also one of Africa’s largest metropolitan consumer markets.

As the country’s economic nerve centre, Lagos holds substantial opportunity across fast-moving consumer goods (FMCG) including food and beverages, home care, personal care and other daily consumables.

Conducting a thorough ‘retail census’ becomes essential for businesses aiming to strategically position themselves and tap into the diverse consumer base of this economic nerve center.

Retail Census Report – Insight into FMCG Market in Lagos

Examining Informal Retail’s Role in Lagos

Distribution landscapes are fragmented, with a heavy reliance on open markets and informal retail channels consisting of small, independent provision stores, chemists, kiosks and street hawking.

Modern trade remains relatively underdeveloped compared to other emerging markets, though expansion is accelerating across grocery chains, speciality stores, and e-commerce.

Even global FMCG giants rely on the dominant informal retail base to drive distribution, often hindered by limited visibility into the micro-level consumer and retail dynamics shaping consumption.

The FMCG market in Lagos is large yet opaque. This shows the great need for dependable, on-the-ground information about what products are available, where they are sold, which brands have the most store presence, and what makes consumers decide to buy.

Retail Census Report

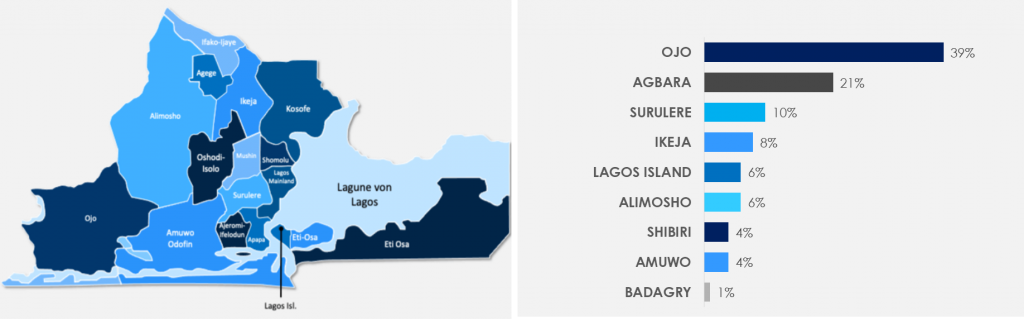

As a top expert in studying retail audit analysis across developing markets, In Nov/Dec 2023, Webhaptic Intelligence conducted a retail census pilot study in Lagos comprising 9 diverse locations and with a designated sample size.

The goal was to understand and enumerate outlets handling FMCG brands/products to consumers across specific locations, and using these to create an ongoing system for monitoring and tracking FMCG sales channels in Lagos over time.

Information Areas

A face-to-face interview was conducted to get more detailed information across the following areas:

- Address details: Recording complete location addresses for each retail outlet provides accurate tracking and geographic mapping at a granular level across different neighbourhoods, streets and market areas.

- Type of shops: Categorizing the specific retail format enables analysis across various outlet types including kiosks, provision stores, specialty retailers, open market stalls, chemists, and wholesale outlets.

- Products/Brands Handled: Capturing brands and product categories stocked and sold across the outlets is a pivotal metric to benchmark FMCG distribution availability and assortment analysis.

- Location of outlets: Pinpointing outlet locations is essential for mapping product and brand availability at a hyperlocal level and determining retail density across different geographic zones.

- Selling areas: Measuring retail selling space offers further insights into outlet potential and range capabilities for stocking products.

- Daily and Monthly Turnover: Tracking sales revenue velocity benchmarks outlet performance and provides baseline demand measures across the retail landscape.

Distribution Stores Covered(%)

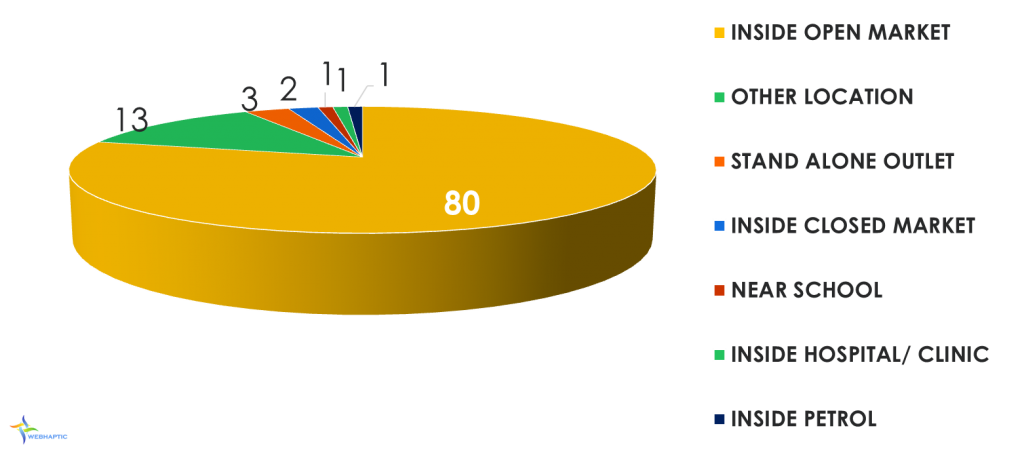

The open market outlet remains a key channel in the Nigerian market setting. Being a place where consumers and sellers interact with each other directly without any barriers, the open market stores with 80% were seen and enumerated in high proportions.

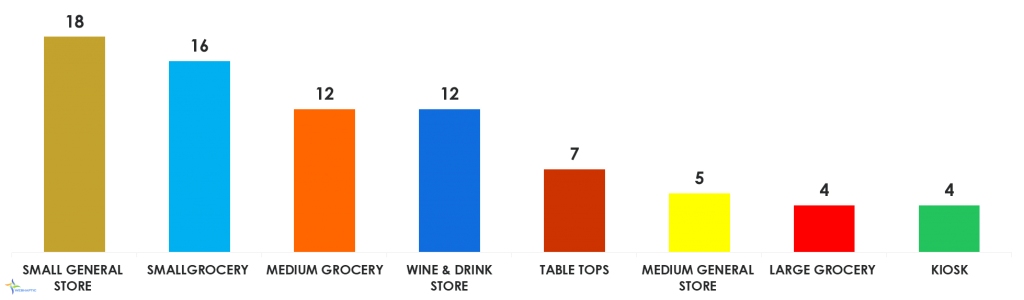

Store Type Split(%)

The retail census pilot study shows that small and medium grocery shops make up almost half (46%) of all the retail stores checked.

This shows how vital these small local stores are for reaching consumers across Lagos with everyday FMCG products. Their large numbers also mean it is key that brand and product availability is tracked at this small informal shop level where most regular household purchases happen.

Product Handling List

The top product categories handled across the audited outlets, in order of high to low proportions, are:

- Non-alcoholic beverages

- Food shelf items

- Personal care

- Household/sanitary products

- Alcoholic beverages

- Confectionary

- Over-the-counter drugs

- Cigarettes

- Refrigerated goods

Non-alcoholic beverages, food shelf items and personal care lead with over 50% of stores stocking products in these everyday essential categories. Their high distribution reach directly aligns with the frequent purchase behaviour from area small-medium grocery shops to meet regular household needs.

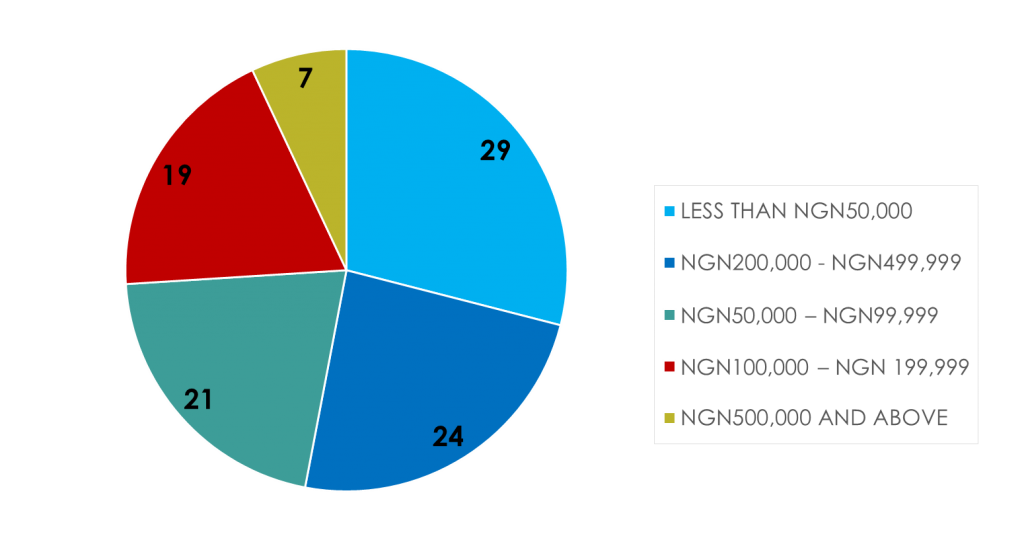

Store Monthly Turnover In Naira(%)

The monthly turnover of the stores covered ranged between less than 50,000 to 499,999.

Want to Find Out More About Retail Census Tracking in Africa?

Webhaptic Research Agency offers detailed and up-to-date retail census data for various African countries, covering both formal and informal markets. Are you curious about how Webhaptic Intelligence can tailor its retail census tracking solutions to your specific needs in Africa? Get in touch to learn more! info@webhaptic